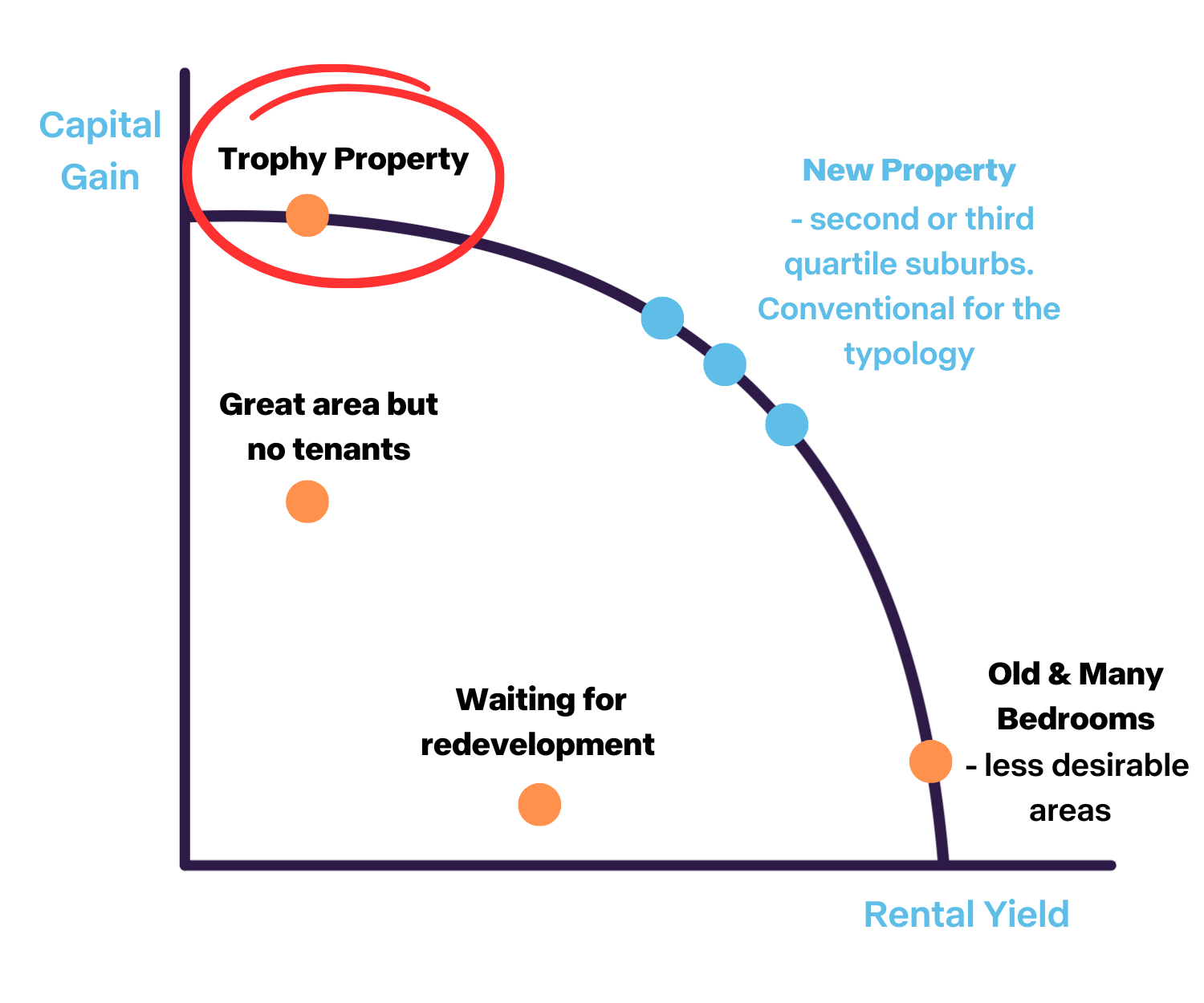

A key concept when selecting investment properties is typology and how this relates to yield and capital gain.

Firstly, let’s simply define yield and capital gain.

Gross yield is the annual rental income generated from the property divided by the purchase price of the property.

Capital gain is the amount the property goes up in value over a specified time.

When cost to own is high it is very easy for investors to fall into the trap of purchasing higher yielding properties in areas with low capital gain to cover the shortfall but over time this can cost them large sums of money – often in the hundreds of thousands.

Alternatively, some investors purchase in areas with very high capital gains with a view to holding them but the cost to own can be crippling in both the short and long term.

The secret is balance. Balance can be achieved in a couple of different ways:

A well-funded or established investor may purchase some higher capital gain properties and some higher yield properties which essentially balance each other out.

For most investors (particularly first time investors) however the safer way to balance your portfolio is by purchasing properties that offer reasonable capital gains and reasonable yield.

Consider the below scenarios:

Scenario A - Anna purchased a four bedroom investment property in a less desirable area of Auckland for $500,000. The area has a forecast ten year capital growth rate of 3%. Anna is renting out the property on a room by room basis and is getting a total of $1000/week in rent. The property therefore has a gross yield of 10.4% - amazing right? No, not quite – whilst this level of yield is creating a positive cashflow what Anna has neglected to keep in mind is the capital gain of the area she has purchased in and how this will impact her situation over time.

If she holds onto the property for ten years then sells it she will only walk away with equity of $171,958. Even if you add in the $93,080 in positive cashflow Anna has only gained $265,038 in equity for the ten years which is considered very poor.

Scenario B - Tina purchased a three bedroom investment property in an upmarket suburb in Christchurch for $1,250,000.

The area has a forecast ten year capital growth rate of 9%.

Tina is renting out the property for $650/week. The property therefore has a gross yield of 2.7%.

With all the usual costs – mortgage interest, rates, insurance, property management etc it is costing Tina $1031/week to own.

If Tina sells the property at the ten year mark she will have equity of $1,709,205 – sounds great doesn’t it? Not quite, the property has cost Tina $536,120 to own over those ten years which eats into the equity gain substantially.

Whilst the left over equity is still sizeable at $1,173,085 the real issue is that Tina would have likely struggled to get more lending to buy further investment properties as the banks would not be happy with the huge cost to own of this property.

The answer is to buy investment properties with a balance of capital gain and yield in mind, this will enable an investor to continue to grow their portfolio at the most efficient rate and maximise their net equity in the long term.